When to fix profits in cryptocurrency investments?

There are a number of factors to consider when planning to sell your crypto assets. Because knowing when is the best time to sell cryptocurrency is important for a profitable return on investment.

Investing in cryptocurrency and seeing the price rise is always nice. Just not knowing how and when to sell cryptocurrency can only hinder an investor’s potential return.

There is a concept of “unrealized profit,” which is when an investor buys a cryptocurrency whose value is increasing, but continues to sit and watch, hoping that the price will continue to rise forever, which, alas, will not happen. Therefore, it is very important to know how and when it is profitable to sell cryptocurrency in order not to miss the right time.

In this article, we will delve into the economic cycles and trends of the cryptocurrency market. We will look at the definition of free market capitalism and discuss a number of ways that can help you plan a profitable investment strategy for selling crypto assets.

Understanding cryptocurrency markets

In 2009, Bitcoin was the first cryptocurrency launched. It was launched by a developer (or group of developers) under the pseudonym Satoshi Nakamoto, and was presented as a decentralized peer-to-peer payment network. By introducing innovative blockchain technology, Bitcoin solved the problem of double spending.

The result is a distributed network of computers working together to validate peer-to-peer transactions. It thus eliminated the need for costly third-party intermediaries between users.

Since then, thousands of different cryptocurrency projects have been launched. Creating a token is now quite easy. The value of a token lies in its usefulness to the project, benefits to its holders, uniqueness and scarcity.

Free market capitalism

Capitalism is famous for its “free market” of supply and demand. In principle, it is not bad for competition, creativity and innovation. In a free market, worthless businesses and assets would be zeroed out and become insolvent, and assets would be redistributed to innovative promising and sought-after companies.

Within the traditional financial industry, however, market capitalism is more likely to be manipulated. This is because local governments, corporate giants, and central banks can jointly influence traditional markets. The relentless greed of corporate directors who disproportionately distribute profits has led, nowadays, to the worst global inequality in centuries.

Blockchain technology has been a real revolution. With cryptocurrencies, all transactions are publicly and securely transparent, and with decentralized funds, the tokenomic design of cryptocurrencies cannot change. The only exception to this rule is when the project community has voted for it by majority vote.

Consequently, neither government nor central bank intervention can affect the crypto project’s dance of cryptography, math and computer science. Token projects are immutable unless the project community votes to the contrary. This in itself is a revolutionary opportunity for the capitalist free market.

When to sell cryptoassets

The skill of when best to sell cryptoassets improves with experience and the passage of time. It is very common for novice crypto investors to sell their assets at a loss. This is simply due to a lack of experience, and thus you fall prey to market psychology trends.

For example, as the price rises, people invest thinking that it will continue to rise. And as the price declines, most people, on the contrary, rush to sell, for fear of a precipitous drop in price. Below we look at some basic tips on how to learn how to time the markets and when to sell cryptocurrency.

Technical Analysis

Technical Analysis (TA) applies to all forms of investments, including cryptocurrency, stocks, gold, and other commodities. TA refers to patterns of market behavior that correlate with patterns on the trading chart. Thus, if investors can understand how to read a trading chart and catch the general market trend and the timing of micro-trends on a smaller time scale, it is easier for them to make probabilistic calculations and assess possible risk.

In addition, TA knowledge is crucial for investors who want to know when to buy and sell cryptocurrency. The general theory of economics is that market patterns are “cyclical.”

TA is a set of trading principles that the trends themselves follow. Thus, being able to identify a significant trend change is a good investment tactic, which consequently helps you understand when it is best to sell cryptocurrency.

Fundamental Analysis

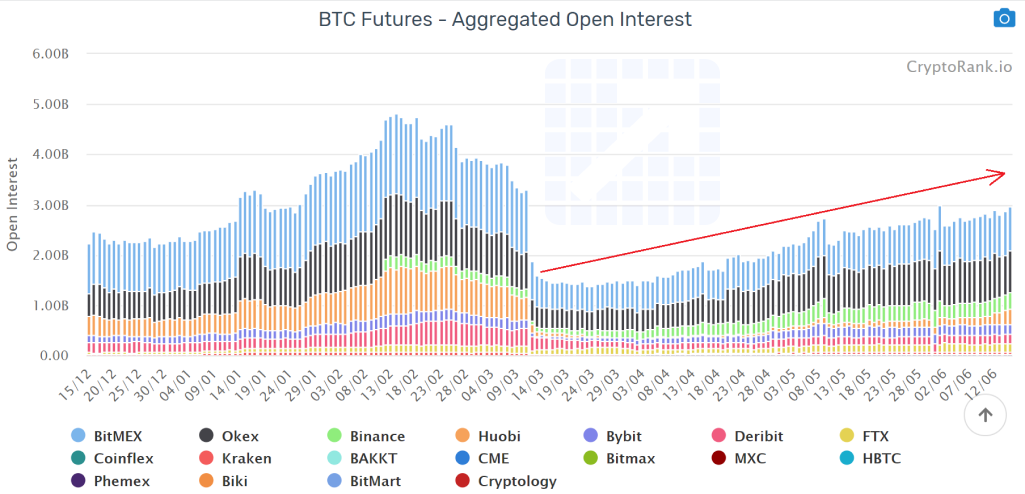

Another form of market analysis more common in crypto markets than in traditional markets is fundamental analysis (FA). Rather than tracking price movements on trading charts, FA focuses on upward and downward indicators in the industry, looking at market trends from a holistic perspective.

By looking at trends and knowing what’s relevant and what’s not, you can greatly succeed in selling cryptocurrency.

Strategic Investment Plan

Another surefire way to profit when selling cryptoassets is to create a strategic investment plan. Long-term and reliable investments in emerging crypto projects with real utility can be valuable and profitable.

The point is to determine your ROI strategy in advance The point is to determine your ROI strategy in advance, and then just stick to your plan when the time comes.

Some crypto investors got carried away with the hype, believing that prices will only rise. What’s more, some investors get greedy and don’t have enough profit already. And this is very dangerous, given the extreme volatility in the cryptocurrency markets. As a result, many investors have missed out on higher profits by selling assets at a lower price during a bear market.

A popular cryptocurrency investing strategy for deciding when it is time to sell cryptocurrency is when the initial investment has doubled, tripled, or even more. Investors then sell their initial investment, keeping the profits they make. As a result, investors will not lose profitable amounts.

DCA Profits

Another popular investment strategy in the cryptocurrency community is often referred to as “DCA-ing,” or dollar-cost averaging. This means that when buying cryptoassets, investors buy a small amount over a long period of time.

For example, with a $200 budget, an investor might buy $20 worth of BTC every day for 10 days. Or they might choose to buy $50 a week for a month. Frequency and quantity don’t matter much. However, DCA is a great way to get the best price exposure of a volatile asset over time.

The same thing works the other way around when deciding to sell crypto-assets. Even with the best technical analysis tools and years of experience, it takes time to reliably confirm trend changes. Trend changes are common and can happen very quickly in the crypto market.

Thus, it has already been proven that knowing the current trends of fundamental and technical analysis and averaging profits from cryptocurrency investments is the most profitable strategy. However, as with any investment strategy, the best solution is to stick to your plan clearly.

Gaining Knowledge

It is important that you understand that education is crucial. Relying on “gut feelings” and advice from friends and family will never be as beneficial as developing a definitive investment strategy and following it.

Moreover, understanding the token project design and value proposition is vital to making the best investment plan. In addition, research and monitoring of market conditions is required to implement an investment strategy at a profit.

The ability to navigate economic cycles and volatile market conditions generates a sense of financial freedom. Understanding when to buy cryptocurrency and when to sell cryptocurrency is a valuable skill that everyone should learn. In addition, to fully appreciate how the global financial infrastructure works, it is worth understanding how it has evolved.

Alternatives to selling

There are many reasons why people may decide to sell their cryptocurrency. Often it is because of a bearish reversal in the markets or when people need more fiat money. If you’re not sure whether to sell your cryptocurrency, here we discuss a few alternatives to selling your assets.

Credit backed by cryptocurrency

A cryptocurrency-backed loan is a great option for those who need quick access to cash but don’t want to sell their crypto assets. Decentralized finance applications (DeFi) offer independent and censor-resistant financial loans. They often require some form of collateral, with the debt-to-collateral ratio varying from project to project.

Instant Loans

For more savvy investors, instant loans offer new investment opportunities. In other words, instant loans allow users to borrow, take advantage of a lucrative arbitrage opportunity and repay the loan, all in a single transaction. What’s more, instant loans require no collateral, but they are more technical and complex to understand and execute than conventional DeFi loans.

Stacking

For investors contemplating when to sell cryptocurrency during a bear market, an alternative is to move assets into a Stacking protocol. This is extremely common in the crypto ecosystem. Users can lock their existing funds into the platform and earn passive interest income. Interest rates are often in the double digits, and some automated market makers (AMMs) offer three-, four- or five-digit annual interest rates. Stacking can be a profitable alternative to selling crypto-assets during a bear market.

HOLD

If you find yourself in a bear market and don’t know when to sell cryptocurrency, an alternative may be to simply hold your assets, which is called HODL. The word went viral after a drunken typo by a user on the Bitcointalk forum, where he wrote “I am HODLing,” which translates to “I am holding,” which can be correlated to “I am holding cryptocurrency during a bear market.”

Bottom line

I hope this article gave you some useful tips about when to sell cryptocurrency. However, don’t forget that the decision to sell cryptocurrency should be your own decision, not because of influence and other people’s advice. Ideally, deciding when to sell cryptocurrency should be part of a larger action plan.

If you don’t know when to sell cryptocurrency, you probably shouldn’t even. The best way to ensure a profitable investment is to do extensive due diligence and learn about market trends and technical analysis.

It’s also worth taking the time and attention to organize your investment strategy and not succumb to hype or greed. Not only is it risky, but it can also be an unprofitable move. Be sure of your investment strategy before you start investing, and stick to your plan.